Financial literacy isn’t just about numbers — it’s about people, real lives, and the lasting effect that knowledge can have on families and their community.

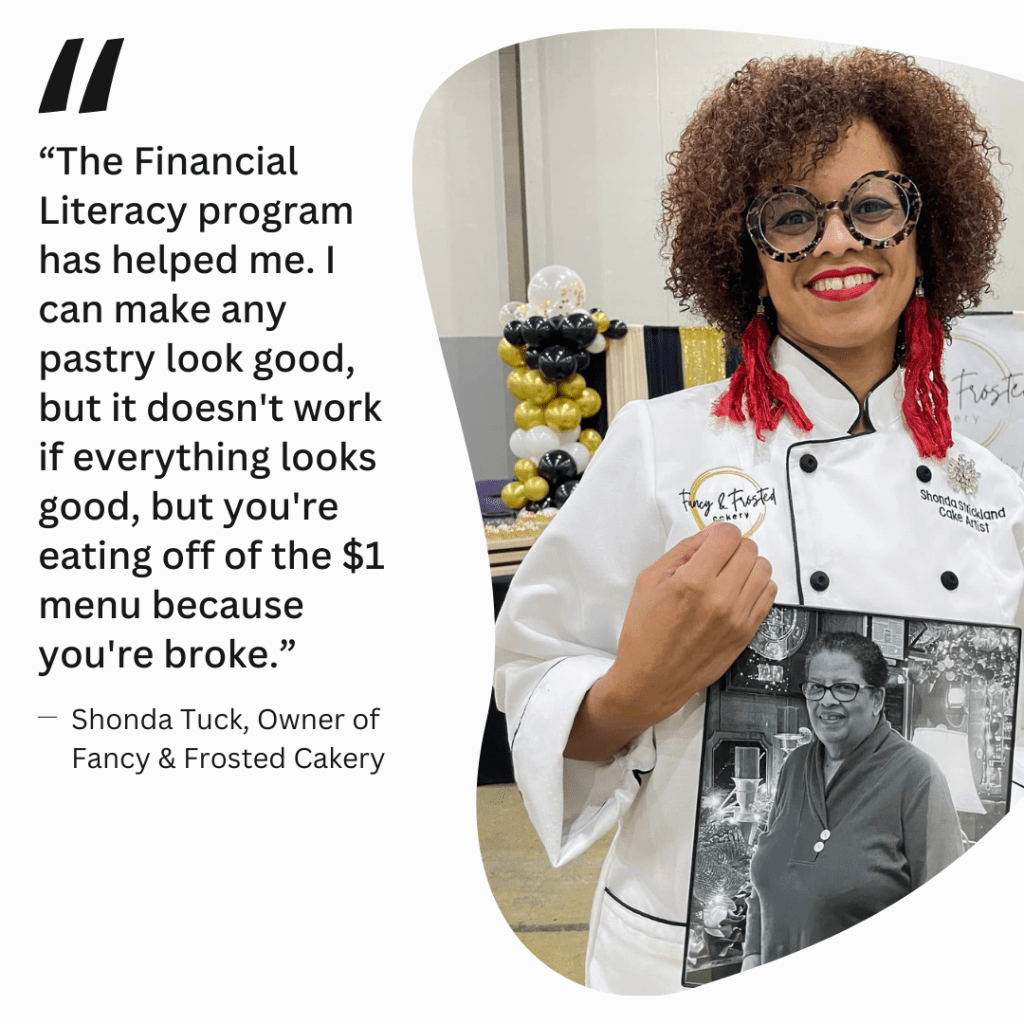

At Chatham Literacy, that impact comes to life through all of our programs, including our Financial Literacy course, and through the work of tutors like Lily Brabble and learner-entrepreneurs like Shonda Tuck, owner of Fancy & Frosted Cakery.

Their story shows how learning about money can open doors, both personally and professionally.

When Shonda first joined Chatham Literacy’s Financial Literacy program, she was already running her bakery but wanted to get a better handle on the business side of things.

“I was interested in the program for business financial sense. I was curious as to how to separate things — like home finances versus business finances. It’s so important not to cross the two over when you run a business. You can’t have one bucket for your finances when you have multiple buckets of income coming in. You have to be able to separate those things.”

For Shonda, the class wasn’t just about balancing a checkbook—it was about building a foundation for her business to grow. She said:

“I am the proud owner of Making It Frosted Bakery. I am NCDA certified, which that is a certification through the Agricultural department of North Carolina. Therefore, I’m able to do everything out of my home. I specialize in custom cakes. I service the Chatham Rabbit in Siler City and make a majority of their pastries.”

Last year I placed Second for People’s Choice in Dessert Wars in Raleigh, and then I progressed on to the nationals, where I came in fourth place for Judges. I’m proud of that, but I’m also proud of what I do. All of those homemade goodies that Grandma and mom used to make — I make those, but I’ve just kind of put a modern twist on it so you don’t lose the foundations of old fashioned cooking or baking.”

Real Tools For Real Life

Lily, who has been with Chatham Literacy for seven years, brings a wealth of experience as a retired educator and a Realtor. She’s seen firsthand how powerful financial knowledge can be. “The modules that were selected to present in this financial literacy program were for individuals that had small businesses. We started out with some basic information because – whether it’s business finance or personal finances — there is overlap. After that, we see where the students’ needs take us,” she said. Lily’s approach is all about meeting people where they are and tailoring the curriculum to fit their real-world needs. For Shonda, the practical tools she picked up made a difference right away:

“I’ve never been really fond of spreadsheets, because I honestly deal with spreadsheets every day. But I actually put together a spreadsheet for my home, and one for my business. Seeing that snapshot is like — whoa, there’s a lot going on here. This program really helped me streamline that. I give credit to the course. It’s one thing to read about budgeting, but another to see your own numbers – home and business – lined up and making sense.”

More Than Skills: It’s Not Just About Money

Chatham Literacy’s Financial Literacy program doesn’t just teach skills; it builds confidence and community. Shonda put it this way:

“Running a business involves a lot of stepping stones. You need to polish everything, and get yourself involved in organizations or different types of entities that are going to help you grow. And so absolutely, the literacy program did help me with that. You know, it just, it helps me be financially smart.”

Lily has seen firsthand how deeply financial literacy can affect people’s lives. Whether she’s working with small business owners, young adults, or county employees, Lily tailors the lessons to their needs and real-life challenges.“Each group, there’s a basic need for financial knowledge,” she explained. “Everyone has basic needs, like needing to understand your credit score and budgeting. Those two areas, they are the most critical. Other people have more specialized needs, and I can help them with that.” Her work has also opened her eyes to the financial realities many face:

“People are often using different types of debit cards that are charging extremely high interest,” she shared. “It seems as if people with less pay a much higher price for goods and services, because they are being taken advantage of financially.” For Lily, teaching financial literacy isn’t just about numbers—it’s about equity and access, about helping people make informed choices in a system that often leaves them behind. “That’s why I volunteer,” she said. “I know that it is definitely needed.”

The Ripple Effect of Financial Literacy

Stories like Lily and Shonda’s are what make Chatham Literacy’s financial literacy program so special. But we can’t do it alone. Your donation, no matter the size, directly fuels our programs and empowers individuals to build brighter futures.